Episode 94: Lyon Financial with Sarah Bess: How to Offer Pool Financing Options to Your Customers

Listen to the episode on Apple Podcasts, Spotify, Stitcher, Soundcloud, Google Podcasts, Youtube, or on your favorite Podcast platform.

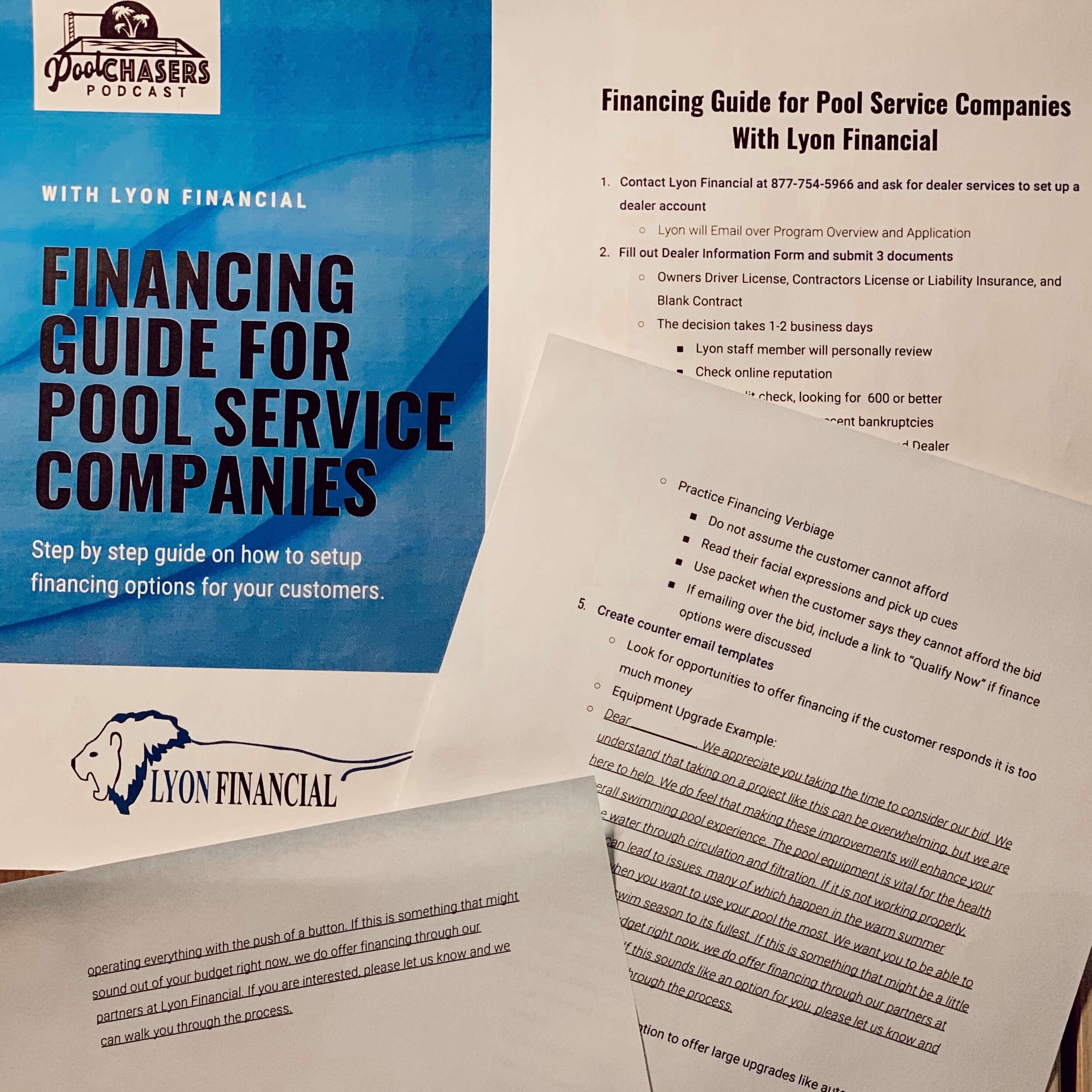

In this episode, we sat down with Sarah Bess who is the Director of Marketing and Dealer Services for Lyon Financial. She jokingly refers to financing as the little “F” word that people throw around, but do not really understand and after recording the episode with her, we agree. As part of the episode, we break down financial terms such as secured and unsecured loans and interest rates so that you can have a better understanding of the topic. This will help you educate your customers when discussing these types of options with them. Swimming pool financing is something that not everyone knows is out there, but they should. It can help with everything from new builds and remodels to equipment sets, pergolas, and even outdoor furniture. As long as the project is over $5,000 there is an option for every type of pool business out there. If we knew this was available when we ran Brothers Pool Service it would have been a no brainer to add to our bid process.

Financing Guide for pool service companies

Step by step guide on how to setup financing options for your customers.

Lyon Financial is all about customer service, they look at it as creating partnerships and are there for you and your customer every step of the way. They offer low-interest rates and long-term loans, and they even have a pool loan calculator right on their website, so your customers can get an estimated monthly payment. With everything going on in the world right now, homeowners will be looking for options to upgrade their backyard experience and you can give that to them. Don’t know where to get started? Don’t worry, we have teamed up with our friends at Lyon to create a custom checklist so that you can become a preferred vendor. Do not miss this opportunity to enhance your customer service, go to the episode webpage to download the form now!

Episode 94 Transcript

Episode 94 Transcript transcript powered by Sonix—easily convert your audio to text with Sonix.

Episode 94 Transcript was automatically transcribed by Sonix with the latest audio-to-text algorithms. This transcript may contain errors. Sonix is the best audio automated transcription service in 2020. Our automated transcription algorithms works with many of the popular audio file formats.

Merlin Industries Ad:

Hey, Pool Chasers. This episode is brought to you by Merlin Industries. Each Merlin liner is custom designed and manufactured and 100 percent North American Virgin Vinyl. That means no offshore material and no reground material. They also offer some of the most impressive lead times in the industry to check out your special offer on vinyl liners. Visit MerlinIndustries.com/poolchasers.

Tyler Rasmussen:

Thank you for joining us today on episode 94 of the Pool Chasers podcast. As always, our mission is to help educate and inspire in the form of a podcast. Have you ever been to a bid and Spent an hour or more there figuring out what the customer wants exactly. Or what they may need for their system to work properly? And then he spent even more time putting together the quote, only to find out that the customer doesn't have the money at this time to get the work done. I know I have, and I know it can be very frustrating and sometimes even discouraging. Well, what if I told you there was an answer for all of that and that answer is Lyon Financial. They not only do a great job financing new builds and remodels, but they have options available for that automation upgrade your customer has been wanting or that new heater that they have been putting off for years. Their finance options started only $5000. If we had known about this at Brothers Pool Service, it would have been a game changer for us. We had plenty of opportunities to offer this to our clients and I'm sure you're thinking of several right now that you can offer it to. During the episode we go over who Lyon is everything that they offer and break down many financial terms so that you have a better understanding of how to offer this option to your clients. So you're probably thinking that all sounds great, but I don't know where to get started. Well, we have worked with our friends at Lyon to create a checklist on how to get set up to offer financing as well as if you sample emails to get you started. This checklist explains exactly what you need to do. That way, you can become a preferred vendor. We encourage you to download it now by going to the episode Web page on our Web site. PoolChasers.com or clicking the link below. Please enjoy this episode with Sarah Bess, Lyon Financial.

Pool Chasers Intro:

Welcome to your go to podcast for the pool and spa industry. My name is Tyler Rasmussen and my name is Greg Villafana and this is the Pool Chasers Podcast.

Greg Villafana:

Thank you so much for joining us today, Sarah. We really appreciate you taking the time to be here with us. Yeah. Can you please introduce yourself to our listeners and just a little bit about how you got to where you are with Lyon Financial today?

Sarah Bess:

Yeah, most definitely. My name is Sarah Bess. I'm the director of marketing and Dealer Services for Lyon Financial. I started with a company in May of 2015. So coming up on my five year anniversary, I was previously in the automotive industry.

Sarah Bess:

I was in sales prior to coming to Lyon. I had a big change in my personal life. I got married and became a mom. So I needed a career change that wasn't going to make me work 10 hour days every day of the week. So I applied online with Lyon Financial and I was interviewed probably five or six times and finally given a shot and have been there ever since.

Greg Villafana:

Very good. Thank you. And where you at? Exactly.

Sarah Bess:

We are located in Mooresville, North Carolina. So on the East Coast.

Greg Villafana:

Okay. And just going back a little bit. You wanna tell us a little bit about how you were raised in all that good stuff?

Sarah Bess:

Yeah, most definitely. So I grew up in Gastonia, North Carolina, about an hour away from Mooresville. Grew up single mom, just me and my younger sister. Pretty basic, simple life. Didn't have a lot. We went to Christian school all my life, my sister and I. So Tyler and I are Christian school kids for life. Yeah. So I grew up Christian school from kindergarten to graduation. Just I think it taught me a lot about morals, faith, kind of figure out the world on your own versus going to say like public school. Nothing's wrong with that. It just gave me a better insight into how I make decisions and how I go about really my day to day life. So.

Tyler Rasmussen:

Yeah. Did you go to the same exact school?

Pool Chasers Intro:

Yes. Yeah, I graduated with 28 people. Probably half of those I've known since I was like five. So that prepubescent stage and all of that. So these people, we really grew up together.

Tyler Rasmussen:

So, yeah, I graduated. We got about a 20 Greg actually graduate with us at that school, but I had been there from kindergarten. So there's seven of us that have been there from kindergarten to graduate. And we had like these pictures of us riding these ponies in pre-school and like there's seven of us on these ponies and then like to seven us in graduation gowns, they kind of did this whole thing and they gave us these weird pens. But it was it was really funny. And that's a pretty unique thing.

Tyler Rasmussen:

I think, you know, having seven people you've known since you were on the preschool playground.

Greg Villafana:

I always tripped out and went to the same school from kindergarten all the way to 12th grade. I know. And I went there. I'm like, this is such a small area, like a little school to have been here literally your whole life where I've been to like 20 schools in three different states.

Greg Villafana:

His point. But yeah, he thought that that was crazy, that it's like you I'm in I'm a senior now and I walk over here by lunch and this is where I was in the first grade. Yeah. Yeah.

Tyler Rasmussen:

Every day they still have like the the pre-school section was separated from nursing school a little bit and they still have like little trikes that they had when I was a priest. These cool little lord trikes.

Tyler Rasmussen:

You drive around. I remember walking by there all the time like man, oh, that's a crazy Schwinn right there. That's awesome.

Sarah Bess:

Yeah. I remember homeroom geometry and like chemistry. We were all like the same class or like for four years.

Sarah Bess:

And so it was fun. I got a great education. It was, you know, it was great. So, yeah, I do sports.

Sarah Bess:

No, I was the anti cheerleader. I was of the Christian school kids. I was a little pop punk person. So I would like dye my hair jet black and wear band t shirts. I should have. So unfortunately, I was the antithesis of the typical Christian school kid. But we definitely welcome friends.

Tyler Rasmussen:

I think you're like the exact person, though, that goes to Christian school. Rebels want to do their thing. Yes. Tattoo's does it say it's like, you know, there are like half of their people there that.

Tyler Rasmussen:

And then there's how people that of, you know, stay on the goody two shoes path. But it's kind of, I think, typical if you go to a Christian school that you find those kids and, you know, like, yeah, that's the kid that likes to just go against all the rules.

Sarah Bess:

Yeah, that was I have I have quite a few stories, but I'll share them later. So I need, you know, Christian school podcast.

Greg Villafana:

Just talk about all the memories of Christian school.

Sarah Bess:

Yeah. I have quite a few good stories.

Tyler Rasmussen:

So I think you're right though. Like I I think I definitely gave us a little bit of a step up of guidance on how to make decisions. And we had Chapel Read Thursday and we had these specific Bible classics to take in different things, which really helped with morals and explaining how life works. I think that a lot of people don't get, you know, going to a public school. So there were definitely advantages to that as well as being in a small school. We were we played football. We did sports. I don't think I was good enough to be on the sports field at a public school. So it's really cool, you know? I got Male Athlete of the year for a senior year, and I think I would have gotten that at a public school.

Tyler Rasmussen:

So, you know, it's really cool to take advantage of some of those different opportunities that are there, right? Definitely.

Greg Villafana:

So what exactly is your position, that line financial?

Sarah Bess:

Yeah. So with being director of marketing and dealer services, I really handled two large parts of the company. Number one, marketing and advertising all falls under my realm.

Sarah Bess:

I manage the company's advertising. We advertise heavily online to consumers. So SVO paper click. All of that falls under my responsibility. Our web site, social media is managed by myself and my team. Email campaigns to our current contractor base, marketing to our current contractors. That all falls under my responsibility. And then the other big part of the department is actually call its dealer services. And really what that means in a nutshell is any contractor who currently works with line financial. Ultimately falls under my responsibility. I approve all new contractors who apply to use our financing. I perform background checks, annual updates. I provide services to them. If they have questions about our financing, we handle that. If they need promotional items, flyers, our brochures, we handle that. If they want us to come visit and meet with their sales team, give any additional training, set up conference calls for training, things like that, I would be. Ispossible for that, right?

Greg Villafana:

And is it your marketing and your advertising towards your customers? Is that pool builders and we're gonna get more into this. But I was curious if if clients that want a pool built find you guys and then they need help finding a builder to build the pool because they've already got the financing for it.

Sarah Bess:

Yeah. So there's a few ways. There's a lot of clients who come to us already for financing because they have a contractor who referred them to us, which is great. And then there's probably about 30 to 40 percent of customers. Just find us online. They think, wow, I can finance a new swimming pool or finance a remodel of my pool. This is great. Let me at least make sure I can get approved and then I'll worry about finding a contractor. Having someone come out and give me a bid so we'll have clients who apply with us first get pre-approved and then they'll actually start shopping. We let the customer have full responsibility of selecting the contractor to perform their work so they can either pick and choose from our dealer directory that we have or they can find someone who doesn't work with us. Currently in my dealer services department would work with that new potential contractor to get them set up with us.

Greg Villafana:

Okay. Thank you. Can you share a little bit about the history with us? Just because curious as to how a financial company finds this niche in the swimming pool industry?

Sarah Bess:

Yeah, most definitely so. Lion Financial was founded by Richard Lyon. He goes by Dick Lion. He started the company in 1979 out in California. He was born and raised in the West Coast and he has started the company.

Sarah Bess:

And how it worked at the time is he would secure financing with this homeowner and he would act that he would pick up the checks and deliver it to the contractor is very small, very, very personal, driving around, delivering checks, things like that, taking paper applications, just very personal and hands on. He was out in California up until the early 90s. He and his wife, Jody, relocated to North Carolina and they start Lyon Financial on the East Coast to try to make the company a little bit larger, cater to more contractors and more customers on a larger scale.

Greg Villafana:

All right. And I know a swimming pool, even at its cheapest, is still going to be pretty expensive. Can you share with us just how much of a demand there really is for pool financing?

Sarah Bess:

Yeah, most definitely. So the company has grown quite a bit since I started in 2015, for example, and last year, 2019, we took about 30000 applications from consumers nationwide that equated to us actually financing about twelve thousand four hundred in some change actual finished projects that totaled about seven hundred sixty million dollars in pool loans that we financed last year alone.

Greg Villafana:

Oh, wow.

Sarah Bess:

So a lot of debt and a lot a lot of customers, a lot of contractors we worked with in 2018. We had taken a little under twenty six thousand and funded about four hundred fifty million dollars.

Sarah Bess:

So over the last several years, we've done closer to a billion dollars in pool financing. And just the last two years alone, I think due to you look at a swimming pool and the cost incurred, the material is incurred, those costs are rising. It's become a lot more expensive products than it was five, 10 years ago. Plus, with the easy access to funds right now through our financing that we offer, a lot of consumers think that it's a very lucrative option and therefore they come to us and she's just secure the funds to us.

Greg Villafana:

And you just finance in North America.

Sarah Bess:

We do. And that continuous 48 states.

Tyler Rasmussen:

How well do you think the consumers are aware of this option being available?

Sarah Bess:

I think with how much we have grown our marketing and advertising over the last couple years, we've really just tried to promote, you know, that line financial with who we are and the services that we offer, the financing options we offer that we're here for you.

Sarah Bess:

The consumer, if you think traditionally about financing, financing is defined as a method of using means to make either a purchase or some sort of business activity. And I think a lot of customers, they've realized over the years that instead of keeping or taking cash out of the bank or borrowing from four one K or using a traditional credit card or refinance of their home, they would rather look outside the box. They want to get online and they want to do their research before they make such a big investment. And then add a lot of cases, they they find us at Lyon.

Tyler Rasmussen:

And it's pretty cool to have that option to finance such a big project. The availability of that is pretty awesome compared to back in the day where there wasn't an option. I think it gives people the luxury of, especially in this time of maybe staycations, that. They have a different option available to them to actually build a home project, which is pretty awesome.

Sarah Bess:

Yeah, most if I think especially with what's going on right now with COVID 19, a lot of customers are definitely wanting to build that backyard oasis. They don't want to leave their house. Many of them can't. They want to go ahead and make that do that research and go ahead and get started.

Sarah Bess:

I think even over the last several years with travel costs, things on the rise that a lot of consumers really just want to make a lifestyle change. They want to build a swimming pool, the outdoor kitchen. They want to make memories with their children or with their grandchildren. And they want to do it and the easiest and most financially flexible way possible. So that's why a lot of clients come to us, a lot of clients like our services and and they use us.

Greg Villafana:

Is there a minimum? Can somebody get finance for, say, just swimming pool equipment? Because that can easily go up to anywhere from three thousand ten fifteen thousand dollars worth of pool equipment?

Sarah Bess:

Yeah. So we can finance really anything home improvement related, even a new pool. Construction is our specialty. Our minimal loan right now that we offer is five thousand. So that's usually great for if it's a line or pool customer wants to replace our line or do some upgrades to their equipment or if it's another type of pool upgrade equipment, add a special feature. Other items that are specifically rated to related to an already in ground pool.

Tyler Rasmussen:

Yeah. Makes it a great option for even service companies to provide that option for their customers I think is what you might be getting. Right. That's cool.

Tyler Rasmussen:

Yeah. And that's why we're so excited to talk with you all because when we had our pool service company, brothers. Pool Service, we got to the point where there was people that needed to do about $5000 plus worth of upgrades to their pool equipment. And they didn't want to use the traditional credit card. They maybe didn't want to touch the savings or whatever it may be. And we ended up putting something on our Web site. And there was one time I just feel like I failed miserably. But, you know, I was so excited because we got it on the Web site, got the little i-Pad and they were up for it. And it was just so many questions it took so long. And by and I had like the brochures of the equipment and all this different stuff. But it just took so long to get an answer back that they ended up. I don't know if they ended up getting a check sent to them or whatever happened, but they definitely didn't get the equipment from us. And I was like, man need to figure this out because it's definitely that is a big thing a lot. So especially swimming pool equipment for us. It's one of those things. It is just it's on the side of the house. It's in the backyard. You don't see it. You might hear it. But when somebody tells you that you need to spend $5000 on getting a new pump and filter and all these different things. That's that's something that people don't really plug into their into their budgets. So giving them, you know, a resource to be able to finance is stuff that's. That's a really cool option.

Sarah Bess:

We try to make it easy for it for both the consumer and the contractor to to offer these options. I think the last thing you want to do, like in your instance, is get excited about offering financing and that, as it turns out, the financing makes it worse. You know, the customer has a bad experience or it takes too long to get an answer or you are charged a fee or charge things outside the box that maybe you, the contractor and the consumer weren't planning on. So I totally agree with you there. You want to offer the option, but you also want to offer the right option, too.

Tyler Rasmussen:

Yeah, it's a good time with this. COVID 19 for heater's. People want swimming pools earlier or later in the season.

Tyler Rasmussen:

Heater's are three to five thousand dollars and you can get a couple upgrades on the pump and things too. That's a cool way to offer, I think for your clients at this moment. Oh, yeah. Bright even a heat pump. Yeah.

Greg Villafana:

He's a nice chunk of change right there. Right?

Pentair Ad:

We want to thank Pentair for supporting the show. You know, as a podcast report professionals, we know that when you sell products, it's your reputation on the line. And when they are Pentair products, it's theirs as well. That's what Pentair's got your back with their trade grade program, which supports your business and reputation by offering exclusive tools and support for lead generation, attractive product rebates and longer warranties and it unmatched expertise when it comes to accurate equipment selection, setup and service. So to learn more about how trade grade protects, empowers and helps your business grow. Visit Pentair.com/tradegrade. That's Pentair.com/tradegrade or click the link below.

Tyler Rasmussen:

So a lot of people might not know about financing, you know, would you sort of explain a little bit? What is it exactly and what are the different options out there?

Sarah Bess:

Yeah, most definitely. So right now, I think traditionally if someone wants to borrow 40 to eighty thousand dollars because they want a swimming pool and the whole nine yards in their backyard, I think traditionally a consumer's going to think of water. Four things. Number one, they're going to use cash. They have the money saved up. They're just going to take it out of a savings account. They may also want to refinance their home. They think that a traditional lending source will not give me amount of money that I'm looking for. And if they do, it's going to be across maybe three or five years. I'm going to have a really high payment. So let me call my bank and let me refinance my house. That's a fairly popular option. I think there's a few cons with that. Number one is you have to have equity in your home if you're going to refinance. If you're a new homeowner or you don't have any equity, that's automatically either question. If you do have equity and you choose to refinance, that's great. It's a pretty aggressive rate because it's secured against your home. It's a refinance, but you also have a really long turnaround. You're averaging a forty five day close and you have closing cost appraisals fees that are involved that are not. You don't incur with someone like Lyon Financial a third popular option as credit cards. A lot of consumers have really high credit line amounts. They're willing to put everything on a credit card and pay for it that way. Unfortunately for contractors accepting credit, our method of payment, you're going to incur merchant fees. So you're essentially paying to allow your customer to pay you by a credit card. The fourth way that a consumer can finance a swimming pool is using a pool financing company. And there are a few out there in the industry. Each one is very different and unique in what they do. We at Lyon, we take great pride in customer service and being there for both the consumer and the contractor throughout the project. So those are really the four options they could choose from.

Tyler Rasmussen:

Right. Yeah, he did. That's a good breakdown of all those. And you know, there are different loans out there secured and unsecured. Can you explain what the difference is between those two?

Sarah Bess:

Yeah. Yeah, pretty much a secured loan. It's gonna be security at something. Most often it's going to be a guest or home.

Sarah Bess:

Those can offer a pretty aggressive interest rates, but that's because if you don't pay, they have something to lean to in order to get funds and then unsecured or signature. A loan has no assets, no backing against it. It's a loan that's given to a consumer solely based on their credit score, good credit history and then the amount of income they have coming in.

Greg Villafana:

Yeah. And I saw here in the form of the little F-word.

Greg Villafana:

I'm assuming that, you know, financing and there's when people think of financing, they think of probably don't do it because it's got a very high interest rate, you know, different things like that, you know. Can you explain maybe why, you know, people don't like to finance?

Sarah Bess:

Yeah. So that and I told Tyler, that's my thing. Financing is a little F word that a lot of contractors throw out there. And either they think they have it all figured out and they know all about it or they don't really know anything about it. And they're just offering is an option, I think. And I can say this because I see it on a daily basis. Just because someone chooses to finance does not mean it's because they have to. That's true. A lot of I would say middle class Americans maybe don't have 40 to 60 thousand dollars in the bank. They maybe have a couple of months worth of income saved up for emergencies. But they have great jobs. They have a good history of paying. They just don't actually have the cash. But who's to say that they can't go and build a pool for their kids and a house they're going to be in for the next, you know, 10, 15 years?

Sarah Bess:

Another thing, too, is a lot of people finance who don't necessarily have to. They do have the income. They have the money saved up. They just choose to finance because it's a good investment. They can take the cash that they would have taken out of a 401k or savings account. They could go and reinvest those funds and finance with someone like Lyon Financial because they can access the funds quickly, easily with no fees or any other outside costing card and be able to take the money they would have spent on the pool and use it for other things.

Tyler Rasmussen:

Yeah, I think typically when people here financing, they are scared off a little bit and they look at it as maybe I shouldn't do this because they can't afford it. But a lot of reasons, like you just said, it's good to finance because you're not going in a deep hole just to get a project for your house or family.

Tyler Rasmussen:

Because right now people really want to spend time with their families and kids and give these options of being the home that you come to, you and your kids come to and, you know, making memories. I think that's really important to a lot of people, especially when something rocks the world like this, where people are realizing some of the more important things with their families. Getting this option to do that is cool because you get to make memories, but you're also not depleting your savings or taking out high interest loans. It's cool option.

Greg Villafana:

And you guys can probably answer a lot of questions people might have that pertain to a swimming pool or just the backyard experience because you guys are sort of financing inside of this niche instead of maybe Bank of America or one of these big banks that, well, anything that you bring to the table that you want financing for, they're really just going to give you a set amount of money at an interest rate. But they're not really going to deal with contractors. They're not going to do anything like that. That's a really it's really cool. You guys do. And being in this niche, I would think that that would be much easier for us as professionals discussing that with the homeowner that, you know, we want to get you hooked up with a finance company that actually specializes in financing swimming pools when pool equipment, all the different things to make your backyard this oasis that we're we're talking about, right?

Sarah Bess:

Yeah, I think for most consumers and for most contractors, I mean, in terms of financing, again, there are some contractors who do have a negative connotation with it.

Sarah Bess:

I've had several guys personally tell me, well, if my customers are finding out they have no business building a pool, because if they're financing, they obviously don't have money and are getting a debt. Shame on them. I mean, I've had guys tell me that, you know, I don't feel that way. I think a lot of consumers just want to make that decision because it's ultimately what betters them. They can keep. Like I said, they're money. They can keep their cash and investments. Or if they truly don't have the funds, they don't have. Maybe they only have thirty thousand dollars. But they want to add, you know, an outdoor kitchen and extra decking or a paver patio financing.

Sarah Bess:

Was actually gives the contractor the ability to upsell that project and ultimately sell a higher bid. So I think that's also a great way to from a contractor how you can look at offering financing, so to speak, to that point. I think that's another good point, too.

Greg Villafana:

And that's a good relationship to start off with you guys, because I feel like if I had a pool built, but maybe I wasn't ready to do something else in the backyard, maybe you could do it at another time where it's kind of seeing how this all goes and plays out. And it's like, you know what, maybe in a few years I'm ready to kind of redo the backyard, get the new barbecue installed in all those different things.

Sarah Bess:

All right. Yeah, we do a lot of repeat customers. We have customers who built their first pool. They financed it. Who I and three years later, they moved and their new house does not have a pool. So they come to us again to finance that new pool. We don't have as many repeat customers as I would say traditional business model, because most consumers, they're building a pool. They're saying they're home for a while. So I don't have repeat customers per say for homeowners. We have just the repeat contractors that we do a lot of business with. But yeah, we have customers that can come in and get a couple different loans with us. We have some customers who because their front yard gets messed up with the pool being built. They'll finance our pool with us and six months later come back and finance landscaping and a new driveway because they got cracked or something like that.

Greg Villafana:

So you ever get to see the end product, somebody gets a pool built or a backyard and you ever get to see what it turned out like?

Sarah Bess:

We get photos at every stage of the process for every single customer that we work with. So we'll have photos from excavation. We'll get photos. Once steel is done and gunsights being shot, we'll get photos when they're doing plaster and then we'll get a final completion photo. Most of the lenders we work with don't even want the photos because they trust us at Lyon, but we apply and get it just to really keep a track on the customer and make sure things are going as planned.

Sarah Bess:

So we love getting these photos. We get so many fun ones, happy ones. We actually take them and share them on social media a lot of times, too. So so we get every single one of the twelve thousand four hundred products we did last year. We have a couple three of the three or four photos on each one of them.

Greg Villafana:

So that's really cool. Who submits those photos?

Sarah Bess:

The builder, either the builder or the customer.

Tyler Rasmussen:

Nice. Yeah, that's awesome. Good to see the end product. It's also a good way to protect you. You know, I think as well. So you can see the different stages.

Sarah Bess:

Yeah, I must f and that's why we at Lyon as really. And I know we'll get to this, but why we do what we do this is why we have some of the most aggressive terms. And interest rates out there for consumers is because the exclusive lenders that we work with, they trust us and know that we are going to partner with this customer until the project is completed.

Sarah Bess:

The customer has a completed pool. They don't get left in the middle of construction by someone who shiza them out of money and left the job. They're going to finish that pool. They're gonna be so happy and they're gonna make their monthly payment. So the lenders are really happy about that. They'll continue to do business with us at lyon and and give us really the most aggressive lending options out there in the industry. So that way we continue to provide our services for consumers and contractors.

Tyler Rasmussen:

Yeah. And you were talking about different interest rates. Can you explain maybe how the interest rates are determined?

Sarah Bess:

Yeah, most definitely. So say with a traditional secured loan, the interest rates could. I'm just going to speak generally could be a couple of points to up to 6 percent because the loan is secured by some sort of item which is most commonly the consumer's home.

Sarah Bess:

Our interest rates are structured a bit differently because all of our laws are signature or unsecured loans. So that means we are not using the customer's home as collateral. Interest rates are going to be determined specifically by the consumer's credit score and then also DTI or debt to income ratio. That's how much money the customers coming in versus their debts going out. Usually we like to see 50 percent or less. Right now I offer the longest terms. I offer term options of anywhere between 3, 10, 15 and 20 year terms. Interest rates will vary based on credit score. My most popular option right now is 6.9 9 percent. That is for a 20 year term. This is a signature loan. No prepayment penalties. So customers can pay them off early at any time. They're not charged for any pre computed interest or additional interest.

Greg Villafana:

So when you say six point nine nine, what is the average interest rate for something like that?

Sarah Bess:

Yeah, so I would say the six point nine percent that is for our A bar or that's for someone who has excellent, excellent credit. Our interest rates can vary. I would say most common is anywhere between 7 and 12 percent. That's for just the average borrower. You know, some people will say, wow, I my customer got a 12 percent interest rate. I can't believe it. That's so high. Well, what they don't understand is it's for two hundred and forty months. It's for a 20 year term loan. So the customer maybe has a higher interest rate than, say, a short term personal loan, but they're also stretching the loan out across 20 years. So that way they still have a low fixed monthly payment. If you compare our swimming pool loan to a personal on a traditional bank like Bank of America, Wells Fargo or local credit and a customer could walk in and ask for sixty thousand dollars and they might get approved for it.

Sarah Bess:

But the interest rate could be anywhere between five and 10 percent and the term will be five years. And if you do the math, the customer's monthly payment is going to be double what they would have gotten with us at Lyonne at a 20 year term. So you really have to break it down and look at the whole picture when you're looking at an interest rate versus a term and then versus the the services that you're actually getting with Lyon.

Greg Villafana:

Right. I'm sure that, you know, if you get a little bit of a higher interest rate, you can always reapply. Maybe some years down the road, can you get. Can people do that?

Sarah Bess:

So once the consumer has the loan with us, they cannot reapply to lower that interest rate. But because there is no prepayment penalties, on average, 75 percent of our customers pay off their loan within five years or less anyways. So a lot of consumers will just pay it off with cash or they will refinance their home and use the refi proceeds to pay off our loan. Or, you know, they could get a big bonus or something else at the end of the year and pay down on the loan that way too.

Tyler Rasmussen:

The average person, too, is really concerned with the monthly payment is probably where that decision is made to a lot of people, you know, you're budgeting for, you know, what you can afford. And, you know, that's the most important piece for a lot of people, I'm sure.

Greg Villafana:

Right now, I'm not sure if does the value of the home go up when a swimming pool is added to the back yard? And how is that determined?

Sarah Bess:

I think that's like what came first, the chicken or the egg? I mean, I've I've heard so many different things. There's a lot of people who sell a swimming pool and say it's an investment as an enhancement to the home. It may raise the value of your home some, but it's stuff you're definitely not going to get the full price out of it. So if you build a sixty thousand dollar pool, sixty thousand dollars is not added to the value of your home. I know that for sure. I also think it depends on the area you're in, too. If you're in somewhere like Florida or California or even Texas, I mean, almost everyone has a pool in their backyard.

Sarah Bess:

It's pretty normal when you get to other areas like here in the south where we're located and even maybe northeaster a pool is not as common. Some people may actually see it as a negative because they have to pay maintenance cost and start up in the mail, just the maintaining of the pool itself as a cost. So I think it does add some value to the home. It's not as much as what you paid for it. I think it does have some value. It ultimately adds a feature to the home that many people who want that lifestyle are looking for.

Greg Villafana:

Right. It definitely makes it more appealing if you were ever to sell your home. You know, you're looking at a house with no pool. And then you look at a house with a beautiful pool, backyard, maybe a pool fence up to date equipment, stuff like that. Definitely. Especially if you have kids. They're definitely going to want to go with the house with awesome backyard and pool.

Tyler Rasmussen:

Right. And especially like a Sunbelt state. I think it's very important. I know Arizona, definitely the pools with homes sell quicker. You know, they bring more value because people want that option when it's a hundred and 15 degrees. That's crazy.

Greg Villafana:

I see a house without a pool here. It's like when did you get the pool removed?

Sarah Bess:

Right. Right. You get a. All right.

Tyler Rasmussen:

Well, I think in the Northeast, you're right, because, you know, our brother in law and sister in law is from Connecticut. And some of those people, they look at those pools, a lot of them don't want to get a house or the pool because it's, you know, a huge expense or something.

Tyler Rasmussen:

There's a different mindset depending on where you're at, for sure.

Sarah Bess:

All right. Yeah, I think for the most part, those are how many consumers just see it as such a positive thing. A poll is technically considered a luxury item. It's kind of like an RV or record or other recreational vehicle. It's not a necessary home improvement. So you really have to treat it differently. And that's why we found this nation, what we do, what we do. It's really about building that lifestyle, creating those memories. You know, in that backyard where you don't have to leave and go to the community, pony your neighborhood or go to a lake or somethin where you're out if you even have one. So I think, you know, maybe there's not that monetary value you get from it, but you definitely have that emotional value from it because you know that you're you're gonna use it, right?

Tyler Rasmussen:

Yeah. I think you save a lot of money a long run, too, because if you go to Disney World or Disney Land with two kids in a family like you're spending 20 grand, easy to be around thousands and thousands of people waiting in lines and not really even if it's a waterpark, it's like not as convenient fun as pool.

Greg Villafana:

You got two daughters. You know how much the little dresses cost at Disneyland? Yes, we go. We have boys. But I had three males are goofy for a few days. So I help out some of this.

Sarah Bess:

Yeah, it isn't too expensive. I actually watched Disney when I was in Florida for the Everything Under the Sun Expo. So my two assistant managers and I were at Disney without kids and we had a blast, but we spent money in the eight hours you were there. So, yeah, you know, people these vacations, people usually save up for them and they go and it's a blast.

Sarah Bess:

But especially when you start having a family or as you get older in age, you know, it's not that easy to go hop on a plane and go travel somewhere, maybe especially with everything that's going on right now. You can't travel, you can't go anywhere. So you know, why not take advantage of it? Just hunker down at home and make it everything that you guys could want and then some. I think that's the mindset of a lot of people right now.

Greg Villafana:

Yeah.

Greg Villafana:

Might get a call for me one day to see financed some nachos and some stuff at Disneyland. Yes. And it up over here. Yeah. Yeah.

Sarah Bess:

I looked at my credit card statement after that trip, but I was like, man, I should have done that. But you know, like $20 for a sandwich and stuff. Yeah. You know, we had fun.

Greg Villafana:

So even the smallest things that you think like. You know what I'm just going to do is this only boo 5, 10 bucks. It's like, yeah, that's 50 bucks or so. Like, what the hell? Just need one.

Sarah Bess:

Yeah, yeah. I got a keychain for my son. It cost like $12 keychain, you know, but it's weird.

Tyler Rasmussen:

Everything in the sun. I were walking around Universal, the studio area, and we're like, maybe we should just go to Universal for a little few hours and have some fun and walked off. There is like one hundred and sixty nine dollars per person.

Tyler Rasmussen:

And I was like, no, sorry.

Greg Villafana:

Great business people pay. All right. All right.

PoolRx Ad:

Well, it's that time of year again. PoolRx is having their spring big sale event. That means it is time for you to stock up for the summer when we are running brothers. This was one of our favorite times of the year. We got a discount on the product, but more importantly, we were setting our pools up to be successful and reducing chemical usage, which saved us a ton of time and money. Let me tell you a bit more about the product PoolRx eliminates and prevents all types of algae reduces chlorine demand. And last up to six months with PoolRx, there is no need for phosphate removers classifiers or other algaecides. While using PoolRx you will see high definition water clarity. I mean these pools just pop right now. You can get $15 off a four pack of blue units and 1750 off a four pack of black units at your favorite distribution location. The sale ends April 30th. So get them while you can if you want to find out more about the product and how we used it for our company. Please go listen to Episode 8 of the podcast and you can also visit PoolRx.com by clicking the link below.

Tyler Rasmussen:

So let's get back to the prices of the loans.

Tyler Rasmussen:

If I'm a homeowner seeking a loan from my pool and I come into the office or I'd call you guys, what does the process look like?

Sarah Bess:

Yeah, for sure. So we definitely encourage consumers if they have questions, call us. Customer service is our number one priority with most people wanting to borrow this much money. They definitely want to call and speak to someone before actually filling out an application. So definite encourage the consumer to call us or go ahead and apply online. What happens next is we have different departments and teams who handle the customer's application really until their projects finish. Every single application we receive at Line Financial is personally reviewed by someone in our applications department. So what we're doing is we're looking for ways to approve this homeowner versus just turning them down. Whether that be we feel that this homeowner they need a co applicant will call them and ask if they have one. And if so, get that information. Sometimes customers fat finger the application, they mess up, they put their job title is vice president of operations and say that they make a thousand dollars a month. Well, common sense tells me that's probably not correct. So we'll call them and verify information if we need it. We then send the application to one of the seven lenders that we work with. We ally and we do not make the loans.

Sarah Bess:

The lend exclusive lending partners we work with, they actually make the loan and hold the loan. So we'll submit their application to a lender. They'll look at it and typically give us a decision same day or within 24 hours when we have an approval for the customer, we call them and email them. We tell them congratulations, tell them the interest rate term, how much money they were approved for. We'll tell them what exactly we need. Usually that's a pay stub dated within the last spot last year, W-2 and a copy of the driver's license. In most cases, if you're self-employed, we may ask for some tax returns, but it's overall a very simple process. Once we reviewed your income and we know you didn't lie a lot about how much money you made, your loan is ready to go. You just send us a copy of your pool contract with a approved contractor Lyon Financial, someone who is a current vendor of ours who we do business with. And then you sign your loan documents and you're ready to start construction if they want to use somebody that's not quite approved the client yet.

Tyler Rasmussen:

Can they do that process with you to get you and.

Sarah Bess:

Yes. We set up on average anywhere between 60 to 100 new contractors a month because consumers want to use ABC pool somewhere. And we don't currently work with them. But they this consumer really wants to use them. So that's actually part of my department's responsibility as we reach out to this contractor. We say, hey, listen, your customer came to us for financing, you know? Have you heard of us? You know, here's how we work. Do you want to get set up? So we go over the process with them. We review in detail how we work. The contractor would then fill out a one page, really an application information form. I do a brief background and typically have that contractor set up within a day or two. So I actually talked to a lot of different contractors every month. So that's one of the good things, too, is we're constantly growing our contractor network because these consumers find lion and they want to use the guy down the street, but he doesn't work with us. So that's one of my responsibilities as well.

Greg Villafana:

Yeah. And I'm assuming if anybody a pool builder, pool service, any one of those wants to recommend lyon financial or put it on their website or anything like that, do you recommend them reaching out and kind of getting that relationship established and kind of the best practices for even just talking about services that you guys provide? Do you recommend that for people?

Sarah Bess:

Oh, for yes, certainly. I definitely encourage anyone who has questions. The way we've done business has definitely evolved over last several years. So there may be contractors who worked with us five or six years ago when things are a lot different now. Definitely. Call us send us an email. I have six employees and the Dealer Services Department dedicated solely to our contractors, answering questions, getting them an account set up with us. So it's very simple. I encourage everyone they can more than happy to reach out to them and talk to them for sure.

Tyler Rasmussen:

Nice. And you have like materials in different ways to give them options.

Sarah Bess:

Yes. So what we do now and we're really hands on and our approach with both the consumer and the contractor. If someone wants to offer financing, really, they don't know where to start. They don't want to talk about interest rates or terms with that customer, because you may say the wrong thing. Customer doesn't maybe qualify for that and they get mad at you. So my biggest thing is, you know, a lot of our contractors just say, hey, called Lyon. What we do is we provide the contractor flyers for a short pamphlet, payment charts. We provide services such as, you know, our videos, a how to on applying and how we work. We are an open book. We share that with all of our contractor base. Once I set up a new account with us and then as you go through the year and you need more materials or you need something from us, you know, just call us and we'll be more than happy to get that handled.

Greg Villafana:

So write for all the builders and people that you deal with, the ones that are getting the best results in terms of, you know, just communicating it to their clients and whatnot. What are they doing exactly? Which all resources that you offer. Are they putting into their business to become successful in actually people getting money for their build?

Sarah Bess:

Right. So because we offer the longest terms and the lowest rates right now, it's pretty easy sell for contractors. They just say, hey, call lyon. They have terms up to 20 years. It'll be a low monthly payment for you. Give them a call. And then usually a lot of our contractors, especially beginning of the year, they'll ask for like several hundred or even a thousand fliers, no shores. They go ahead and make up their promotional packets that they hand out to new potential customers at bids and say, hey, if you are interested in financing, I do have I do have a preferred partner. I have several preferred partners. Here they are. Give them a call. I think it a lot of contractors. We pride ourselves on our partnership with them. They know that they can just direct the customer to us. We have about 50 employees. So any time someone has a question, they call us during business hours or call will be answered within a couple of rings.

Sarah Bess:

They know that they can just direct that customer to a live representative who can answer their questions and really answer their questions like that. I think the last thing you want to do is if a customer ask of you financing options, say, I don't call your local bank and see what they do. You know, a customer may do that and then realize that, oh, I can all get approved for like 20 grand and it's a five year term and that doesn't meet my needs. I'll just wait. You know, I think if you have the customer call like someone like Lyonne and you, the contractor, you can call me. I have contractors that call me all day long and say, hey, what's going on with this application or where are we at with this guy and this this person, you know, and I'll tell you and we'll work together to get them go in and get the project started.

Right. And do you have stuff that people can put on their Web site? Is there is there stuff like that that can go out in a email blast? Because I know even with the invoices that we would send out or emails to our customers when we had a pool service business where we would recommend new equipment, you know, is there a little things that can put in their signature? You recommend anything like that because that it could be just sort of talking about breadcrumbs in the breadcrumb trail of how we can do that. So ways of always putting it out there where that is an option where you might see this, I'm recommending this and it might be five to eight thousand dollars, but you don't have to just pay cash or using a credit card. We do have a partner that offers financing. So you guys have any assets or things that people can use to put on Web site or for email blast or something?

Yeah, for sure. We have graphics. We have. We have little blurbs that we share with contractors that they can use. I think especially when you're bidding new pool construction or even a remodel equipment, I think a lot of people like contractors just assume that consumers pay in cash. And I think it's important, especially if you're spending you're bidding a job and you're spending all this time with the consumer as ask them, how are you paying? Not necessarily. Well, how are you paying for this? My recommendation to many contractors, if they asked me for it, as I say, ask the customer how they're paying. Say, listen, here's the bid. Here's what I can do for you. I'm not sure how you're going to pay for this, but I do offer financing. If you're interested. I'm more than happy to share more information. I also take cash, check, credit card, kind of sell it and almost like in a passive way. And then the customer could say, well, I plan on paying cash for this. Or they could say no. Well, tell me more about your financing. And what is that? What kind of terms are rates are their contract or can just hand them a pamphlet or a flyer about line financial? What we offer the customer can go ahead, apply online, or they could just call us fast if they have questions and and get the process started from there.

Greg Villafana:

Right. Thank you. I'm thinking now when there's kind of a bidding war going on, sometimes if there's a way to communicate that you've given information to a certain homeowner. So that if they do contact you, it's kind of tied to that company in case they might forget that, you know, maybe somebody they want to pool built or something doesn't remember the name of your company. But do you have a system in place or something to wear when they're calling and asking questions?

Greg Villafana:

It's tied to that builder or that service company.

Sarah Bess:

If you ask if it's just an about phone call, they usually tell us who they're using. But on our application. So when someone actually applies, they do tell us what contractor they plan on using. And as long as that someone who's a part of our network already, I actually tell them and update them on what's going on with our customer. So say of Joe Smith applies and he's approved. I will tell his contractor, Alan Smith pools or whoever it is, I'll say, hey, guess what? Your customers pre-approved with us. Send in the copy of the signed contract when you can. So if a customer actually applies, we do keep in touch with the contractor and keep them updated on the loan status. So that way they can help, too. And in staying up to date on what's going on. So if a customer calls and it's hard to keep track because I mean, we probably take we could probably take anywhere between two to five hundred calls a day. But if a customer does actually apply and we know who their contractor is, we will keep them updated throughout the process.

Greg Villafana:

Nice. Probably a good idea to staple your business card to that pamphlet, too.

Sarah Bess:

Yeah. Yeah. Good for sure.

Greg Villafana:

You know, and I know we've talked a lot about how you guys are different, but maybe we can just specifically ask and you can list all the list, all the different ways.

Greg Villafana:

That Line Financial is actually unique and different than other no pool financing options that are out there.

Sarah Bess:

Yeah, most definitely. So with there is a lot of pool financing companies out there and a lot of them just give the funds direct to the customer for a lot of consumers. That's OK. First thing, I'm cut some consumers. That's a good option. They get the cash on hand. The biggest difference with us that lie in financials, unlike everyone else, we actually pay the contractor directly in installments around the project. We don't give the money to the customer. This creates a partnership with the consumer and the contractor for. Anywhere between a month to six months until this project is completed. A lot of consumers, if they go to a traditional or another type of pool financing company, they're usually being charged as some sort of fee in order to obtain the funds. And then the customer essentially turned into a cash customer. For some customers, that's a good option. So say, for example, if a customer goes with another pool financing option and they get the cash on hand, they've paid a fee. They've gotten the cash from this other pool financing company. You know, there's a very good chance that that customer changed her mind. They may not want to build a pool anymore. They may realize, hey, I really need to pay off this debt or I need you know what? Let's take that dream vacation we never took or something could happen. Another thing, too, is they may still want the pool, but they may not.

Sarah Bess:

They may want to try and change the design and not have it cost so much. They may say, well, I have the 60 grand could really use 10 grand to do this. And maybe we can work with the the the designer in and change the price of the pool. Another big thing, too, is when a consumer has the cash, they're making the payments to the contractor. And for most contractors, that's great. But if you get into contractors who may not be of good quality and who maybe take advantage of a homeowner, talk the homeowner out of more funds upfront, and then they leave the job. Unfortunately, that still happens even in today's age. They're still contractors or pool owned professionals who go out there and they take money from customers and they don't actually finish. The job gives the industry a bad rep. There's one of these guys in almost every county, in every state out there with us here at line and how we work. Customer never gets cash from us. All payments are disbursed directly to the contractor in installments or on the project. That's why those pictures come in. The customer of the contractor sends us photos at each stage. The customer authorizes the release of the funds and then funds are H.H. to that contractor directly, properly. This way the contractor knows where his money is coming from.

Greg Villafana:

I'm curious on on that note, how frequent is the builder a check from you guys? Do they get to pick, you know, what, day in the month? Because I know they're usually using that money to pay subcontractors to doing different phases of the pool build. I'm just curious what.

Greg Villafana:

When would they expect is it? Once a month, every two weeks?

Sarah Bess:

Nope. It's usually within two business days of us receiving. We received the photo and then the customer authorizes the funds through an electronic form.

Sarah Bess:

And then usually within two days after that, the contractor would have his funds an immediate thing. So that way he can go ahead and pace of contractors or order materials or do things with the funds. He gets paid promptly at that particular phase.

Greg Villafana:

All of the money. I thought it was broken up.

Sarah Bess:

No, it is broken up. So say if someone's it's a fifty thousand dollar pool. Say it's a concrete pool. The contractor would get twenty five percent of the funds that excavation. Twenty five percent of the funds. Twenty five percent usually at Tiel coping or when the decking is poured depending on the scope of work and then the last twenty five percent is at completion. So at each phase to actually get his fonds he just sends us a photo and then the customer authorizes the funds and then he has his money within a couple business days after that call.

Greg Villafana:

And what if you don't get a picture?

Sarah Bess:

We have to have a picture.

Sarah Bess:

There's if there's a few guys that we do a lot of business with that we they still send us the photos. We just don't have the customer authorize the funds because that's we trust them. We know that they're not going anywhere. These are guys that we do 20, 30 million dollars a year in finance business with. But we always get a photo just so that way we can keep track with a customer, too. We know where they're at with the process. We've had a few guys a few years ago who sent us fake photos. They are building a pool down in Tennessee and they're sending us photos with palm trees and sand in the background. And we're like, no, this isn't right. So we have to have the photos and the authorization from the customer. But we get the builder paid as fast as we can, which is usually a couple days after that.

Greg Villafana:

I think that's that is really cool because if you say there's a it's protecting the builder and the homeowner. If subcontractors coming out to do shop, create or gunfight or anything like that and they don't show up or something, they get halfway through and they stop or whatever happens. You could actually hold up those funds instead of all the money being in one place where they might have paid the sub beforehand and they just walked away from a job. So I think that is I think that's a really, really good idea.

Sarah Bess:

Yeah. And that, I think is one of the biggest reasons why we are so successful, why so many consumers come to us is because we are involved until the project's done. There's a lot of consumers going back to the beginning of the podcast where they don't have to finance. I have seen customers up high with us who make one hundred thousand dollars a month. They don't need to finance. They have the money, but they choose to use us because of the services we offer. Unfortunately, because of how much business we do and how active we are in the country, seems like almost every month someone's going out of business or someone has done something and there's customers left hanging. We had a situation just a couple of months ago. I went to Florida, went out of business and we had about 12 projects under construction. That was just our projects. The contractor had another probably half dozen who paid cash. And he got those customers who pay cash to go ahead and the money. And I mean, and they were S.l. Well, they didn't have any money left to build a pool. They consumers who were financing through us, they only had so many payments paid out as per where they were that construction. So thankfully, we still had enough funds for them to go find another contractor to finish the job. Those negative instances don't happen often, but when they do, then that just kind of really reiterates what we do at Lyon and how much value we offer the consumer, especially in a day and age where some businesses things happen, you know, and ultimately we're protecting that consumer and that contractor as well in that particular situation.

Greg Villafana:

Yeah, that would be that's probably one of the best selling points in aligning them with the right finance company to get a loan for their build. Is explaining everything you just said to me. If I'm I need a loan of that amount of money, one of my projects, that's a good piece of mind knowing that no matter what. Everything is gonna be OK.

Sarah Bess:

Right. Yeah. And that's again, that partnership. And and, you know, sometimes contractors. I'll talk to new contractors. You've never heard of us before. And they'll say, well, why don't you give the money, the customer?

Sarah Bess:

And it's you know, I explain really what I just said is, you know, it's ultimately to protect you and that consumer just in case anything were to go wrong or here. And then they'll tell me a story. They say, yeah, there was a so-and-so down there, you know, in another county who just got popped for doing this and this. And, you know, and fortunately, it still happens. So with consumers, even if they don't have to finance with us, they have the money, but they like that piece of mind and having that partnership. So having us involved until we have that final picture of them swimming in their pool and our kids are smiling, that that means a lot to a lot of consumers.

Tyler Rasmussen:

Yeah, it gives the contract your peace of mind to knowing that their funds are there and that the customer didn't lie and say they have them and didn't continue to project that they couldn't afford.

Tyler Rasmussen:

So there's a lot of security on both sides. It's really cool that you guys do that.

Sarah Bess:

Yeah, for sure. And they way we try to go the extra mile for both the consumer and the contractor. I think a lot of traditional banks and other pool financing companies, they don't want to deal with the contractor. They don't want to do all this work. They don't want to talk to the customer or talk to the contractor and check in all construction, see how things are going. You know, they just want to give the money to the customer and say, you have a great day. I'll see you later. You know, and we want to be as hands on as possible. We want to be there for that consumer. And for that contractor. If something's going on, we'll do what we can to help both sides. And really whatever we can do to get a finished project, we'll make sure we get it done.

Tyler Rasmussen:

Yeah. And you and I have had several conversations in your team. And is the your customer service is very important to you, you know, and every time you guys talk with us, that's one of the main points you touch base on. And I think that really shows.

Sarah Bess:

Yeah. I mean, it's not necessary. Just the bad apples for the contractors. I mean, there's customers, too. And I know I told you several these stories in Florida, but, you know, I've had instances where consumers are being picky and maybe they don't want to sign off on that last payment to the contractor. They want to nit pick something that is considered warranty work or or something that just shouldn't be held up for a final funding for. We deal with that quite often as well. And we really do try to go above and beyond for each contractor in that phase. We work with them and that customer to work out any issues there could be. We really do try to go above and beyond for all parties. And that's again, go back to that partnership piece and really why we do what we do.

Greg Villafana:

Yeah. So I know we've talked about. A lot of different options, different types of loans that you guys do, but can you just specifically tell the listeners what are all the different types of loans and options that you guys do offer now?

Sarah Bess:

Most definitely. So as of right now, our core specialty is the long term signature loan. That's a term choice. The consumer has to choose either a 12, 15 or 20 year term. It's a loan minimum of five thousand. And as of right now, we'll finance up to hundred thousand. We also have a short term rate special going on right now. And I just got word it's until the end of April. It's two point nine percent for three years only. It has to be a loan of fifty to seventy five thousand in most cases. It's great for that customer who maybe would pay cash, but lots of really low interest rate to invest that cash you would pay for a pool. These are all signature unsecured loans, which means there's no collateral, no assets involved or solely looking at the customer's credit score, their overall history, making sure they have good credit history, not a lot of derogatory marks. And then also looking at their debt to income ratio. So how much money they have coming in first is debts going out as long as it's 50 percent or less in most cases, we have some options for them.

Greg Villafana:

Thank you. So, sir, is there anything that you want to add this topic with? You know, what's separating, you know, line financial from other pool farm finance companies?

Sarah Bess:

Yeah, for sure. So Lyon again, we've been around for over 41 years. We pride ourselves on a true partnership with both the consumer, the homeowner and then that contractor.

Sarah Bess:

So we pride ourselves on that customer service in that relationship. We've been around for a long time. Not only is our customer service second to none and our project management involvement told the project is done.

Sarah Bess:

But because we offer awesome, great rates and the longest terms and the best options right now, that's cater to all consumers. I really just think that it's part of why we're so successful, why we continue to be around for a long time in the years to come.

Sarah Bess:

We have so many great things going on right now with especially even with what's going on with COVID 19. We actually have seen a gain in applications were up about 20 percent. Consumers looking for full financing, actually. So just a lot of great takeaways, especially with what's going on right now in the industry. There's some pluses for sure. What's going on?

Tyler Rasmussen:

Yeah. Thank you. I think there is there's definitely pluses to find quite a few places and we're just going to try to remain positive and look for those. What do you think is the biggest takeaway you want the industry to get from this episode?

Sarah Bess:

So for us, that line and with what we do, I mean, we'll finance new pool construction as our specialty. But if it comes down to a hot tub, equipment repair, remodeling of a pool, another outdoor home improvement, a lot of our pool contractors and people we do business with are kind of a one stop shop. They do it all. So whether you're a smaller remodeling and service company or you're a large new builder, we do have financing options for your clients more than happy to review your options with you. See what's going to work best for your business model and just see what we can do to help grow your business and offer the best financing options out there.

Tyler Rasmussen:

Awesome. Thank you. Where can people find more information about you and follow you on your social channels?

Sarah Bess:

Most definitely. So people can contact us on our Web site at Lyon and Financial Dot Net. We're also very active on social media saying go to our Facebook page and also our Instagram account, Lie Financial Pullens. We're also on Twitter. So if you have questions, just want to check us out. Feel free to go there. Meekan D-Mass, contact us online. Send us a message. Whatever you want to do to get more information. We'll be happy to reach out to you and talk to you more about us.

Tyler Rasmussen:

Awesome. We really enjoy working with you and your team and you. Thank you so much for the support. And we're excited to continue this relationship forward. And we appreciate you joining us in the podcast today.

Sarah Bess:

Now, no, thank you for having me again. The pools industry, that's our niche. We've been around for a long time and continue to be around whatever we can do to help better the industry and and keep everyone moving forward in a positive and growing direction. That's what we're here for.

Tyler Rasmussen:

Well, thank you. Thank you. Thank you, guys.

Tyler Rasmussen:

Thanks for checking out this episode. If you want to find out more about our guest or the sponsors of the show, you can check them out on the links we have provided in the righta below. We have also provided links to our social media platforms. So please follow us on Instagram, Facebook, Twitter and YouTube. Our tag is Pool Chasers. The podcast is brought you any value. Please do what you can to support us through our Patreon on page by going to Patreon.com/poolchasers. And don't forget to subscribe to the podcast to be updated each time a new episode is released. One last thing, if you're not yet in our Facebook group, join in today to be surrounded by like minded individuals who are all trying to better the industry. Thank you all for the support. We appreciate your time and your ear. See you out there Pool Chasers.

Quickly and accurately automatically transcribe your audio audio files with Sonix, the best speech-to-text transcription service.

Sonix uses cutting-edge artificial intelligence to convert your mp3 files to text.

Automated transcription is getting more accurate with each passing day. Are you a radio station? Better transcribe your radio shows with Sonix. Manual audio transcription is tedious and expensive. Do you have a lot of background noise in your audio files? Here's how you can remove background audio noise for free. More computing power makes audio-to-text faster and more efficient. Automated transcription can quickly transcribe your skype calls. All of your remote meetings will be better indexed with a Sonix transcript.

Sonix uses cutting-edge artificial intelligence to convert your mp3 files to text.

Sonix is the best online audio transcription software in 2020—it's fast, easy, and affordable.

If you are looking for a great way to convert your audio to text, try Sonix today.

Show Notes

[02:43] - Introduction to Lyon Financial Director of Marketing and Dealer Services Sarah Bess

[03:39] - Sarah Bess grew up in Gastonia North Carolina and went to Christian School Kindergarten through 12th grade. Just like Tyler Rasmussen.

[08:09] - Sarah’s role and responsibilities at Lyon Financial

[10:46] - Lyon Financial History

[11:50] - The demand for swimming pool financing

[15:09] - Financing swimming pool equipment or anything home improvement as long as it’s over $5,000

[18:33] - Pentair Trade Grade program

[19:14] - What is financing and what are the different options out there?

[21:27] - The difference between secured and unsecured loans

[22:32] - The “F” word finance and why some people don’t like this option

[27:04] - Repeat customers for adding additions to their backyard

[27:58] - Lyon gets photos of each phase of the swimming pool build process

[29:54] - How interest rates are determined

[33:43] - A swimming pool adding value to the home

[36:34] - Saving money by buying a pool because of what you save from vacation trips

[39:01] - Stock up for the summer with PoolRx Spring Big Sale Event

[40:07] - The loan process for a homeowner

[42:33] - Lyon sets up between 60-100 contractors a month

[44:36] - Proving contractors with flyers, pamphlets, payment charts, etc.

[45:32] - How are contractors getting the best results from using Lyon Financial

[47:41] - Adding graphics and other assets offered by Lyon to websites and emails

[51:41] - How Lyon Financial is different and unique compared to other financing options

[54:21] - When will the contractor building the pool get the check?

[57:01] - Involved until the project is complete

[01:01:42] - Different loan options with Lyon Financial

[01:03:44] - Gain in applications recently during COVID-19

[01:04:19] - Biggest takeaway from this episode